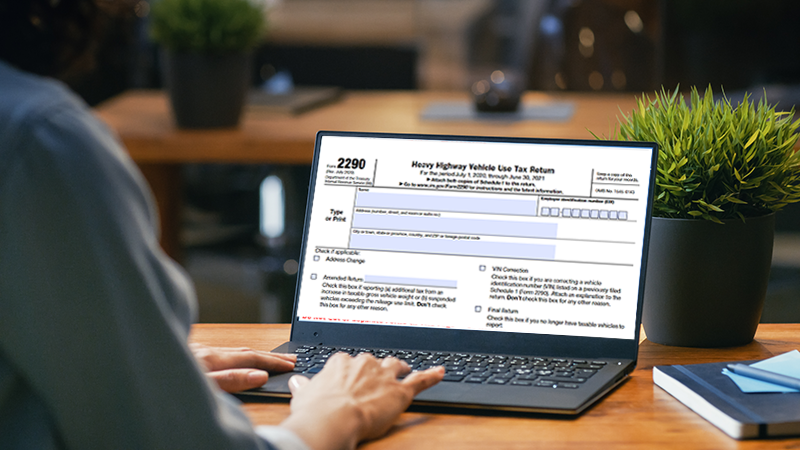

In order to make filing Form 2290 online easier we’ve developed multiple features to make the process

quick and easy.

In order to make form file 2290 easier and approve your Schedule 1 via email in a matter of minutes, You can also opt to have us fax or Postal Mail.

Your IRS Form 2290 will be accepted and you will receive your Schedule 1, or your

money back!

Do you have various trucks to file for? No problem! You can save time while e-filing with our bulk upload feature which can accept up to about 40,000 trucks at once.

Instant Error Check is a feature that helps to check, If there are any errors that are found while filing the Form 2290. It helps you to change the errors and before transmission to the IRS.

If you accidentally enter the wrong VIN or make a VIN typo while filing Form 2290 online, don’t worry. You can easily make a free IRS 2290 VIN correction. You can also file a Form 2290 amendment.

In case if your 2290 is rejected for any error, you can easily fix the errors and re-transmit it again with the IRS for free.

The below mentioned are the requirements that you have to keep in hand before E-filing form 2290.

Visit https://www.expresstrucktax.com/hvut/e-file-form-2290-online/ to learn more about 2290 form filing

The best way to file Form 2290 online and pay the amount of heavy vehicle use tax you owe is right on your iPhone, iPad, or Android Devices with the Form 2290 filing app. Download the app, follow the Form 2290 instructions, pay your Form 2290 cost, then receive your Form 2290 Schedule 1 via email.

Form 2290 is the federal excise tax. Heavy vehicles with a gross weight of 55,000 pounds or more must annually e-file 2290. The American Association of State Highways officially announced the Heavy Vehicle Use Tax (HVUT) in the late 90’s as the heavyweight of trucks was causing the most damage to public highways.

All truckers, drivers, or owner operators in the trucking industry need to file Form 2290 online by the Form 2290 due date. Once you file your IRS Form 2290 is submitted the IRS checks it to make sure it’s correct. Then the IRS will send Form 2290 Schedule 1 to the taxpayer. Form 2290 Schedule 1 serves as proof of HVUT payment.

Visit https://www.expresstrucktax.com/efile/irs2290/ to know more about 2290 Form with the IRS.

Once you e-file IRS Form 2290 the IRS checks to make sure it’s correct and applies a digital watermark to your Form 2290 Schedule 1, which is commonly referred to as a stamped Schedule 1. Your electronically stamped Form 2290 Schedule 1 serves as proof of payment for Form 2290 and all DMVs will accept this document. Visit https://www.expresstrucktax.com/hvut/form-2290-schedule-1/ to know more about stamped Form 2290 Schedule 1.

The current IRS Form 2290 tax period began on July 1, 2023 and will end on June 30, 2024. And the deadline for the regular tax period will be August 31. You need to e-file 2290 forms according to your vehicle's first used month because Form 2290 is due on the last day of the month following your first used month. For example, if a vehicle is first used in November, the Form 2290 due date for that vehicle is December 31st.

However, with our Form 2290 filing software, you don’t have to worry. Making it easy to file by the Form 2290 due date. Then you’ll receive your Form 2290 Schedule 1 via email almost instantly! Plus, we offer an extremely low Form 2290 cost!

Visit https://www.expresstrucktax.com/hvut/irs-form-2290-due-date/ to know more about the deadline for form 2290.